Last week, after dogged pressure from watchdogs and transparency advocates, the Department of Treasury released some data on the recipients of the Paycheck Protection Program (PPP), which was designed to help weather the Covid storm. The program was designed to provide loans to businesses that became grants if they used the money to keep employees on payroll This is a strategy to provide temporary relief while preserving the relationships between employer and employee that makes businesses function.

As has been widely reported, PPP was passed hastily, and the national administration sought to remove, ignore, or weaken oversight measures. To some, it looked a lot like a massive slush fund. This has rightfully gotten a lot of coverage. From the start, it was clear that the $$ wasn’t all going to folks who needed it most. Some of the high-profile recipients (Chicago sees you, LA Lakers…MJ is the GOAT!) returned the data, The data release has revealed more ironies among the recipients of social insurance.

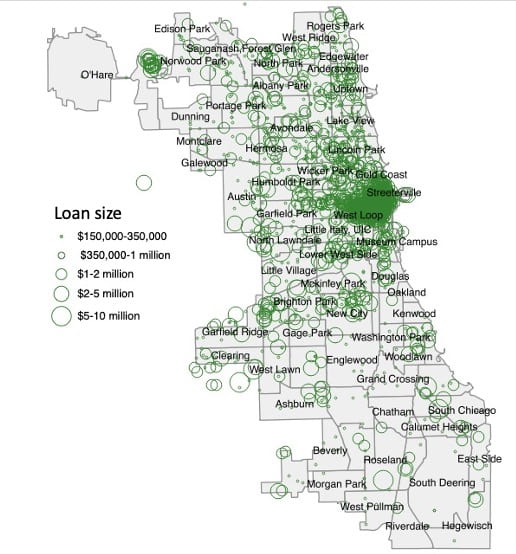

There were over 600,000 recipients of the rapid-response program, so there were bound to be some errors, oversights, and con artists. But what about in general? Where did the money go? I took a quick look at the approximately 7,600 recipients from Chicago, and it’s a frustratingly familiar story. The money flowed downtown, and to richer areas of the city. Here’s a map showing the location of each loan’s recipient, with the bubbles indicating the size of the loan (this one is for loans of more than $150,000 only).

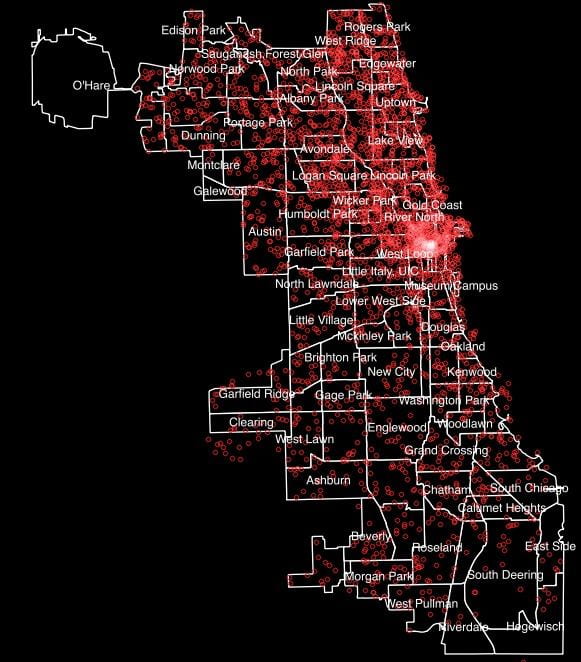

It makes sense that the central business district gets the lion’s share of large loans–lots of firms and HQs are located there. But outside the Loop, we can still see stark inequalities. Especially on the South Side, there are only a few per neighborhood, while there are dozens or hundreds up North. This map (apologies for the color inconsistencies) shows the rough location of smaller loans of less than $150,000. The pattern basically the same across neighborhoods:

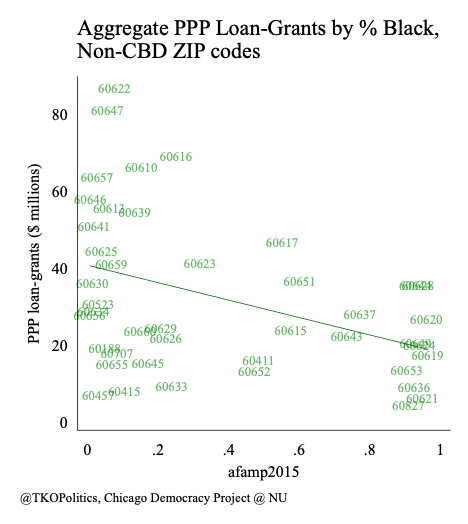

The next figure shows the estimated aggregate total loans to each ZIP in the city (but outside the Loop) by percent Black. The ZIPs that are <5% Black (c’mon Chicago, it’s 2020) got about twice as much money as those that are more than 90% Black–about $30m more on average.

There are nominally race-neutral “explanations” for this pattern, but they all fall back on a mix of decades of disinvestment and business-first program design. Statistically, the relationship is a function of wealth/income–that is, in a multivariate analysis, the relationship between income and assistance swamps race’s independent correlation–but that’s a function of discrimination past and present, and it’s also a morally unsatisfactory explanation to fall back on “it’s not whiter areas that are getting more aid, necessarily–it’s richer ones.” We need to collect further data on employment and business locations to analyze whether the money distributed evenly across employers instead of space or people. Again, that would also be a lagging indicator of disinvestment in Black communities, and relying on money to trickle down through employers far across the city is insufficient.

There are nominally race-neutral “explanations” for this pattern, but they all fall back on a mix of decades of disinvestment and business-first program design. Statistically, the relationship is a function of wealth/income–that is, in a multivariate analysis, the relationship between income and assistance swamps race’s independent correlation–but that’s a function of discrimination past and present, and it’s also a morally unsatisfactory explanation to fall back on “it’s not whiter areas that are getting more aid, necessarily–it’s richer ones.” We need to collect further data on employment and business locations to analyze whether the money distributed evenly across employers instead of space or people. Again, that would also be a lagging indicator of disinvestment in Black communities, and relying on money to trickle down through employers far across the city is insufficient.

Program design–funneled through banks, and based on first-come, first-serve application–also advantaged firms with specialized services, those who can pay someone else to get themselves paid. This is harder for mom-and-pops firms, and harder in areas with fewer banks. So even when we put the scandals aside, this well-intended street-level bailout program may have exacerbated inequalities, because those who need it most are not situated to get the help. PPP is a good idea, but direct, generous aid to individuals is better, especially now that it’s clear this crisis will not resolve itself in a month.

Other countries didn’t seem to have as hard a time doing this as us, another reminder that our leaders, policy patterns, and federalism are all making it harder to manage this crisis and costing lives by the day. We have to do better for South Siders and similar areas in other American cities, especially because these same communities are both bearing the brunt of the pandemic, the attendant economic crisis, AND leading a prophetic revolution to save our collective future.

You must be logged in to post a comment.