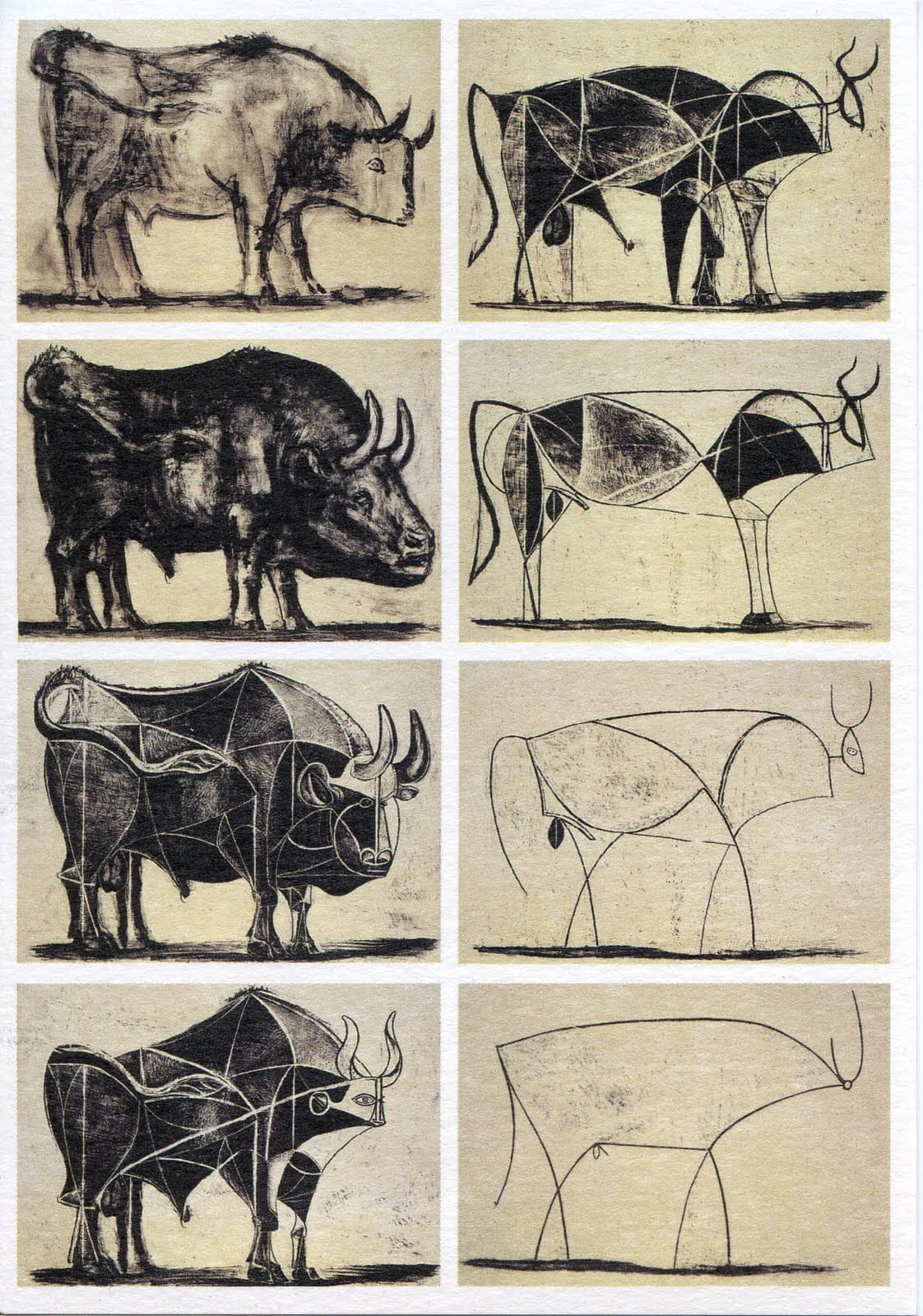

Picasso’s Bulls, December 1945 — January 1946.

Required Textbook: Hartline, Mechanism Design and Approximation, manuscript, 2016.

Current Term: Fall 2021.

Previous Terms: Fall 2018, Fall 2016, Fall 2014 (Harvard).

Synopsis:

This course studies the design of mechanisms to mediate the interaction of strategic individuals so that desirable outcomes are attained. A central theme will be the tradeoff between optimality of an objective such as revenue or welfare and other desirable properties such as simplicity, robustness, computational tractability, and practicality. This tradeoff will be quantified by a theory of approximation which measures the loss of performance of a simple, robust, and practical approximation mechanism in comparison to the complicated and delicate optimal mechanism. The class focuses on techniques for performing this analysis, economic conclusions, and consequences for practice. The class will follow the textbook manuscript at: http://jasonhartline.com/MDnA/.

Prerequisites: Prior experience with algorithms or game theory is recommended.

Homework Policy: Homeworks are to be done in pairs. Both students must contribute to the solution of all problems. One copy of the assignment should be turned in with the names of both students on it. Both students will receive the same grade. You may consult the text book and course notes when answering homework questions; you must not consult the Internet or research papers.

Tentative Schedule:

- Week 1: Mechanism Design and Approximation Overview

- Topics: mechanism design, approximation, philosophy thereof, first-price auction, second-price auction, lottery, posted-pricings

- Reading: Chapter 1.

- Week 2: Equilibrium

- Topics: Bayes-Nash equilibirum, dominant strategy equilibrium, single-dimensional agents, BNE characterization, revenue equivalence, uniqueness, revelation principle, incentive compatibility.

- Reading: Chapter 2.

- Week 3: Optimal Mechanism Design

- Topics: single-dimensional mechanism design, surplus-optimal mechanism (VCG), revenue-optimal mechanism (Myerson), amortized analysis, virtual values, ironing, revenue curves, revenue linearity.

- Reading: Chapter 3.

- Week 4: Bayesian Approximation

- Topics: reserve pricing, posted pricing, prophet inequalities, correlation gap, matroids, monotone hazard rate distributions.

- Reading: Chapter 4.

- Week 5: Bayes-Nash Approximation

- Topics: first-price auction (asymmetric distributions), simultanious composiotion, “price of

anarchy”, “smoothness” paradigms. - Reading: TBA.

- Topics: first-price auction (asymmetric distributions), simultanious composiotion, “price of

- Week 6: Prior-independent Approximation

- Topics: Bulow-Klemperer, single-sample mechanism, digital goods.

- Reading: Chapter 5.

- Week 7: Prior-free Approximation (Digital Goods)

- Topics: prior-free methodology, monopoly pricing, random sampling auction, profit extraction, lower bounds.

- Reading: Chapter 6, through Section 2.

- Week 8: Prior-free Approximation (General)

- Topics: envy-free pricing, reduction to digital goods, prior-free methodology, monopoly pricing, random sampling auction, profit extraction, lower bounds.

- Reading: Chapter 6, from Section 3.

- Week 9: Multi-dimensional Preferences (Optimization)

- Topics: single-agent pricing, revenue linearity, marginal revenue mechanism, interim feasibility, convex optimization.

- Reading: TBA.

- Week 10: Multi-dimensional Preferences (Approximation)

- Topics: unit-demand preferences, marginal revenue mechanism,

correlation gap, approximate revenue linearity, single-dimensional

representative environments, reduction to single-dimensional pricing. - Reading: Chapter 7.

- Topics: unit-demand preferences, marginal revenue mechanism,

- Week 11: Computational Tractability

- Topics: approximation algorithms, greedy-by-value, BIC blackbox

reductions, payment computation. - Reading: Chapter 8.

- Topics: approximation algorithms, greedy-by-value, BIC blackbox